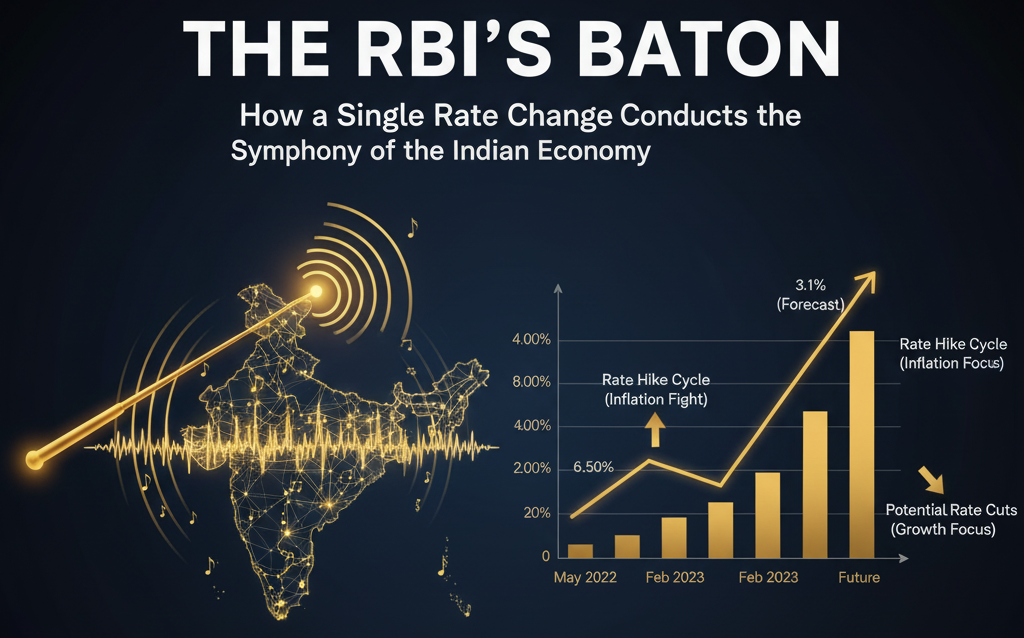

Priya, a young professional in Bengaluru, has her heart set on buying her first car. For months, she has diligently tracked prices, compared models, and, most importantly, saved. But as she approaches the bank for a loan, she notices something puzzling. The interest rate the bank quoted her six months ago is different from the one they are offering today. It has changed, making her monthly payment calculation a moving target. She wonders, who decides these numbers? And why don't they just stay still? The answer to Priya's question lies on Mint Street in Mumbai, inside the headquarters of the Reserve Bank of India (RBI). Think of the RBI as the grand conductor of India's economic orchestra. Its primary job is to ensure that all the different instruments—spending, saving, investment, and prices—play in harmony, creating a stable and growing economy. The most powerful tool in its arsenal, the conductor's baton, is something called the Repo Rate. In the simplest terms, the Repo Rate is the interest rate at which the RBI lends money to commercial banks like the State Bank of India (SBI), HDFC Bank, or ICICI Bank.1 When these banks, which serve millions of people like Priya, find themselves short of funds, they turn to the RBI, their "lender of last resort".3 This transaction is structured as a "Repurchase Agreement" (hence, "Repo"), where banks sell government securities to the RBI with a promise to buy them back at a predetermined future date for a slightly higher price. That small difference in price is the interest, and the rate at which it's calculated is the Repo Rate.2 This rate is the foundational cost of money in the entire financial system. An easy way to understand this is to think of the Repo Rate as the wholesale price of money. If the wholesale price of mangoes goes up for the main distributor, the fruit seller on your street has no choice but to charge you more per kilogram. In the same way, when the RBI increases the Repo Rate, it becomes more expensive for banks to borrow money. To protect their profit margins, they pass this increased cost on to their customers by raising interest rates on car loans, home loans, and business loans.1 A change in the Repo Rate, decided in a meeting room in Mumbai, sets off a powerful chain reaction that travels through the entire economy, eventually reaching the monthly budgets of households and the balance sheets of businesses across the country. Let's return to Priya's dream of buying a car. Her experience is a perfect real-world example of the Repo Rate in action. To combat rising prices after the pandemic, the RBI embarked on an aggressive rate-hiking cycle starting in May 2022. The Repo Rate, which was at a historic low of 4.00%, was systematically increased to 6.50% by February 2023.4 This hike of 2.5 percentage points (or 250 basis points) was directly transmitted to consumers. For a hypothetical ₹8 lakh car loan taken over five years, a lending rate of around 7.5% (in the low-rate era) would have resulted in an Equated Monthly Instalment (EMI) of approximately ₹16,045. After the rate hikes, the same loan might be offered at around 10%, pushing the EMI up to approximately ₹17,000. This tangible increase in her monthly outgo forces Priya to rethink her budget, perhaps opting for a smaller car or postponing her purchase altogether. This is the "loan squeeze"—making credit for homes, cars, and personal expenses more expensive to discourage spending.2 However, the story is different for Priya's retired parents, who rely on the interest from their savings. For them, a higher Repo Rate is welcome news. As banks increase their lending rates, they also need to attract more deposits. To do this, they offer higher interest rates on savings instruments like Fixed Deposits (FDs).1 So, while Priya the borrower is feeling the pinch, her parents, the savers, are rewarded with better returns on their nest egg. This encourages them, and others like them, to save more and spend less, which is precisely the effect the RBI intends. The ripple effect extends far beyond personal finance. Consider a small business owner, Mr. Sharma, who plans to take a loan to build a new factory. A higher Repo Rate means a higher cost of borrowing for his business. This increased cost of capital might make his expansion project financially unviable, forcing him to delay or cancel his plans.8 When this decision is multiplied by thousands of businesses across the country, it leads to a slowdown in private investment. This, in turn, can slow down job creation and dampen the nation's overall economic growth, measured by the Gross Domestic Product (GDP).1 The financial markets are also highly sensitive to the RBI's baton. There is typically an inverse relationship between interest rates and the stock market. When rates go up, corporate borrowing costs rise, which can squeeze profits and reduce future cash flows. This makes company stocks less attractive to investors, often leading to a downturn in the market.7 Simultaneously, the Repo Rate influences the value of the Indian Rupee. A higher rate in India makes investing in Indian assets, like government bonds, more appealing to foreign investors seeking better returns than they might get in their home countries. This influx of foreign capital increases the demand for the Rupee, which can cause it to strengthen against other currencies like the US Dollar.3 The primary and most critical mission of the RBI is to control inflation. Inflation can be described as a silent thief that slowly erodes the value of your money; the ₹100 note in your wallet buys fewer goods and services today than it did a year ago. The RBI's mandate is to keep this thief in check, aiming for a target inflation rate of 4%, with a tolerance band of plus or minus 2% (meaning, keeping inflation between 2% and 6%).10 When inflation threatens to breach this upper limit, the RBI unsheathes its most potent weapon: a Repo Rate hike. The strategy is to make money more "expensive" and thereby reduce the amount of it circulating in the economy. The process, known as the monetary policy transmission mechanism, works in a clear, sequential manner 10: The RBI observes that inflation is rising too quickly, driven by high demand. It announces an increase in the Repo Rate.11 Borrowing from the RBI becomes costlier for commercial banks.13 These banks, in turn, increase their own lending rates for consumers and businesses. With loans becoming more expensive, individuals and companies cut back on borrowing and spending. This reduction in spending cools down the overall demand for goods and services in the economy. As demand moderates to better match the available supply, the upward pressure on prices eases, and inflation is brought under control. The bar chart provided in the query visually tells this story. The tall bars on the left, circled by the user, represent the period of aggressive rate hikes that began in May 2022. This was the RBI's swift response to post-pandemic inflation that had surged past the 6% mark. The subsequent leveling of the bars, highlighted by the user's red line, shows the period from February 2023 onwards, when the RBI paused, holding the rate steady at 6.50% to assess the impact of its previous actions.4 The declining bars on the right of the chart reflect market expectations of future rate cuts as inflation is projected to cool, demonstrating the forward-looking nature of this policy tool. The intensity of the RBI's recent inflation-fighting campaign is evident in the data. Table 1: The RBI's Aggressive Stance: A Timeline of Rate Hikes (2022-2023) Source: 4 However, the RBI's decisions are not made in a vacuum. The central bank is constantly performing a delicate tightrope walk, balancing the need to control inflation with the goal of supporting sustainable economic growth.1 Raising interest rates too aggressively can choke off investment and slow down the economy, while cutting them too soon could allow inflation to run rampant. This is why the RBI's Monetary Policy Committee adopts different "stances." A "hawkish" stance indicates that controlling inflation is the top priority, even at the cost of some growth. Conversely, an "accommodative" stance signals a willingness to cut rates to boost a sluggish economy.12 This dual mandate explains why the RBI might hold rates steady even when inflation is low if it perceives that the economy is growing strongly and needs no extra stimulus.14 While the RBI sets a single Repo Rate for the entire nation, its effects are not felt uniformly. India's diverse economic landscape means that inflation can behave very differently from one state to another. A striking example of this divergence was seen in August 2025. While the All-India retail inflation rate was a comfortable 2.07%, the situation in individual states told vastly different stories.16 Table 2: State-wise Inflation Snapshot (August 2025) Source: 16 This data presents a fascinating puzzle: why was the price level in Kerala surging at over 9%, while in Odisha, prices were actually falling (a phenomenon known as deflation)? The answer lies in the unique economic structures and policies of each state. Kerala's high inflation is a result of a potent mix of structural factors: The Consumer State Problem: Kerala is fundamentally a consumer-driven economy that does not produce a significant portion of its essential goods, particularly food staples like rice and vegetables. These items must be transported from other states, adding substantial logistics, transport, and intermediary costs that are ultimately passed on to the consumer.19 High Purchasing Power: The state boasts one of the highest average wage rates in India. This is amplified by a massive inflow of remittances from its large overseas population. This combination creates very high purchasing power, meaning more money is chasing a limited supply of goods, which inevitably drives prices up—a classic case of demand-pull inflation.20 Local Tax Structure: Southern states, including Kerala, tend to have higher state-level taxes on various goods and services, such as fuel, which directly contributes to a higher cost of living.20 In stark contrast, Telangana and Odisha have managed to keep inflation low through very different, yet effective, strategies. Telangana's Welfare Cushion: Telangana's success in controlling prices is a powerful demonstration of targeted fiscal policy. The state government has implemented several large-scale welfare schemes that directly lower the cost of living for its citizens, effectively acting as a cushion against price shocks.22 Key initiatives include free bus travel for women, subsidized ₹500 LPG cylinders, up to 200 units of free electricity, and free rice for ration card holders. By directly subsidizing these essential household expenses, the government absorbs price pressures that would otherwise be felt by the public. Odisha's Supply-Side Management: Odisha's ability to achieve low inflation, and even deflation, stems from a focus on supply management and its underlying economic structure. The state government actively utilizes a Price Stabilisation Fund (PSF) to manage price volatility in critical commodities like pulses and onions. It builds buffer stocks of these items and releases them into the market whenever prices begin to spike, thereby stabilizing supply and preventing sharp price increases.23 Furthermore, as a state with a strong agricultural base and historically lower per capita income compared to Kerala, the aggregate demand is naturally lower, which also helps in keeping demand-pull inflation in check.24 This state-level analysis reveals a crucial point about the Indian economy: monetary policy is a blunt instrument. A single Repo Rate set by the RBI is designed to manage nationwide demand. However, the drivers of inflation are often local and varied. A rate hike intended to cool down a booming national economy might be ineffective against Kerala's supply-chain-driven inflation, while simultaneously harming investment and growth in a state like Odisha. This underscores the need for a collaborative approach where the RBI's broad monetary policy is complemented by targeted fiscal and supply-side interventions at the state level. Looking ahead, the downward-sloping bars on the right side of the chart suggest that the period of high interest rates may be drawing to a close. With the RBI forecasting a benign inflation outlook of 3.1% for the 2026 fiscal year, well within its comfort zone, the central bank is expected to shift its focus towards supporting economic growth.7 This could mean the beginning of a rate-cut cycle in the near future. What does this potential shift mean for you? For Borrowers: For people like Priya, the era of rising EMIs is likely over. Future rate cuts would translate into cheaper home, car, and personal loans. This could boost affordability and stimulate demand in key sectors like real estate and automobiles.6 For Savers: For retirees like Priya's parents, a rate-cut cycle would mean that the high returns on FDs and other savings instruments will start to decline. This might be an opportune moment to lock in investments at the current high rates before they begin to fall.7 For Businesses: For entrepreneurs like Mr. Sharma, cheaper credit will lower the cost of capital, making it easier to fund expansion plans. This could spur a new wave of investment, leading to more job creation and accelerating economic growth.7 Ultimately, the Repo Rate is far more than an abstract number discussed by economists. It is the RBI's primary tool for conducting the complex symphony of the Indian economy, and its melody directly influences our financial lives. By understanding the story of how this single rate works—from the grand strategy on Mint Street to the diverse economic realities of states like Kerala and Odisha—we can all become more informed listeners and smarter participants in our own financial journeys. What Is Repo Rate? - Meaning, Effects & Process - Axis Bank, accessed September 13, 2025, https://www.axisbank.com/progress-with-us-articles/money-matters/borrow/what-is-repo-rate Repo Rate: Definition - The Economic Times, accessed September 13, 2025, https://m.economictimes.com/definition/repo-rate What is Repo Rate? How Does it Affect the Economy? - Home Credit, accessed September 13, 2025, https://www.homecredit.co.in/en/paise-ki-paathshala/detail/what-is-repo-rate-how-does-it-affect-the-economy Understanding the Impact of a Repo Rate Increase on Your Finances - Bajaj Finserv, accessed September 13, 2025, https://www.bajajfinserv.in/impact-of-repo-rate-increase-on-your-finances RBI Policy Repo Rate - India Indian Central Bank interest rate - global-rates.com, accessed September 13, 2025, https://www.global-rates.com/en/interest-rates/central-banks/13/indian-rbi-policy-repo-rate/ How Repo Rate Affects Housing Loan Interest Rates in India - Shriram Finance, accessed September 13, 2025, https://www.shriramfinance.in/article-repo-rate-and-its-impact-on-housing-loan-interest-rates Current Repo and Reverse Repo Rate 2025: Meaning, Impact & History - ClearTax, accessed September 13, 2025, https://cleartax.in/s/repo-rate THE IMPACT OF RBI'S REPO RATE CHANGES ON THE ECONOMY - IJRAR.org, accessed September 13, 2025, https://www.ijrar.org/papers/IJRAR19D5704.pdf How Repo Rate Cuts Affect Indian Stock Markets? - ClearTax, accessed September 13, 2025, https://cleartax.in/s/how-rate-cuts-affect-indian-stock-markets Repo Rate and Inflation: RBI's Strategy to Control Price Rise - Shriram Finance, accessed September 13, 2025, https://www.shriramfinance.in/article-repo-rate-and-inflation-rbis-strategy-to-control-price-rise groww.in, accessed September 13, 2025, https://groww.in/p/tax/repo-rate#:~:text=When%20the%20market%20is%20impacted,and%20helping%20to%20negate%20inflation. RBI's interest Rates and Impact on Inflation - GS SCORE, accessed September 13, 2025, https://iasscore.in/current-affairs/rbis-interest-rates-and-impact-on-inflation Repo Rate (2025) - Meaning, Current Rates, Difference and Impact, accessed September 13, 2025, https://www.bajajhousingfinance.in/repo-rate Retail inflation quickens to 2.07% in Aug from 1.55% in July, accessed September 13, 2025, https://m.economictimes.com/news/economy/indicators/retail-inflation-quickens-to-2-07-in-aug-from-1-55-in-july/articleshow/123848180.cms Retail inflation climbs to 2.1% in August as food prices soar, accessed September 13, 2025, https://m.economictimes.com/news/economy/indicators/retail-inflation-climbs-to-2-1-in-august-as-food-prices-soar/articleshow/123858996.cms GOVERNMENT OF INDIA MINISTRY OF STATISTICS AND PROGRAMME IMPLEMENTATION NATIONAL STATISTICS OFFICE Dated 12th September, 2025 2, accessed September 13, 2025, https://www.mospi.gov.in/sites/default/files/press_release/CPI_PR_12sep25.pdf Retail inflation inches up to 2.07% in August; food inflation at -0.69% | Economy & Policy News - Business Standard, accessed September 13, 2025, https://www.business-standard.com/economy/news/cpi-inflation-data-august-2025-food-prices-retail-125091200867_1.html After 2 Months of Deflation, Telangana Bounce Back Into Inflation - Deccan Chronicle, accessed September 13, 2025, https://www.deccanchronicle.com/southern-states/telangana/after-2-months-of-deflation-telangana-bounced-back-into-inflation-1903335 Kerala has highest inflation in India, nearly double the national ..., accessed September 13, 2025, https://www.reddit.com/r/Kerala/comments/1jc0isc/kerala_has_highest_inflation_in_india_nearly/ Why Inflation Is Higher in Kerala & Tamil Nadu? - Algodelta Blogs, accessed September 13, 2025, https://algodelta.com/blog/why-inflation-is-higher-in-kerala-tamil-nadu/ Migration of labour from low-income states resulting in higher inflation in Kerala, TN: SBI study - Reddit, accessed September 13, 2025, https://www.reddit.com/r/Kerala/comments/1jfju4r/migration_of_labour_from_lowincome_states/ Telangana In Deflation As Prices Fall - Deccan Chronicle, accessed September 13, 2025, https://www.deccanchronicle.com/southern-states/telangana/telangana-in-deflation-as-prices-fall-1891741 Odisha records one of the lowest inflation rates in June | Bhubaneswar News, accessed September 13, 2025, https://timesofindia.indiatimes.com/city/bhubaneswar/odisha-records-one-of-the-lowest-inflation-rates-in-june/articleshow/123288129.cms An Empirical Analysis of Progress and Prospects of the Economy of Odisha State of India, accessed September 13, 2025, https://www.researchgate.net/publication/343500927_An_Empirical_Analysis_of_Progress_and_Prospects_of_the_Economy_of_Odisha_State_of_India RBI Repo Rate August 2025: No Change, Inflation at 3.1% - My Mudra, accessed September 13, 2025, https://www.mymudra.com/news/rbi-monetary-policy-august-2025-repo-rate-updateThe RBI's Baton: How a Single Rate Change Conducts the Symphony of the Indian Economy

The Story of Your Money and the RBI's Secret Lever

The Ripple Effect: From Mumbai's Mint Street to Your Monthly Budget

The Loan Squeeze & The Saver's Reward

The Corporate Conundrum: To Build or To Wait?

Market Mood Swings and the Mighty Rupee

Taming the Inflation Dragon: A Masterclass in Monetary Policy

A Tale of Two Indias: The Great Inflation Divide

The Kerala Conundrum: Why is God's Own Country So Expensive?

The Telangana & Odisha Story: How to Keep Prices in Check

Reading the Tea Leaves: What's Next for Your Wallet?

Works cited